What Is A Tax Deed In Alabama . The taxes follow the property. there are two types of tax sales in alabama. Fees, and interest on the. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate. The first involves the county selling the taxpayer’s land to pay for the taxes, whereas the. understanding tax lien and tax deed. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. The tax liability must be satisfied by the property owner whether the taxes were incurred. all property taxing jurisdictions receive their proportional share of the taxes and interest on the taxes. A tax lien is a claim made by the government on a property when the owner fails to pay property taxes. a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes.

from www.templateroller.com

there are two types of tax sales in alabama. The taxes follow the property. a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. The first involves the county selling the taxpayer’s land to pay for the taxes, whereas the. all property taxing jurisdictions receive their proportional share of the taxes and interest on the taxes. The tax liability must be satisfied by the property owner whether the taxes were incurred. understanding tax lien and tax deed. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. Fees, and interest on the. A tax lien is a claim made by the government on a property when the owner fails to pay property taxes.

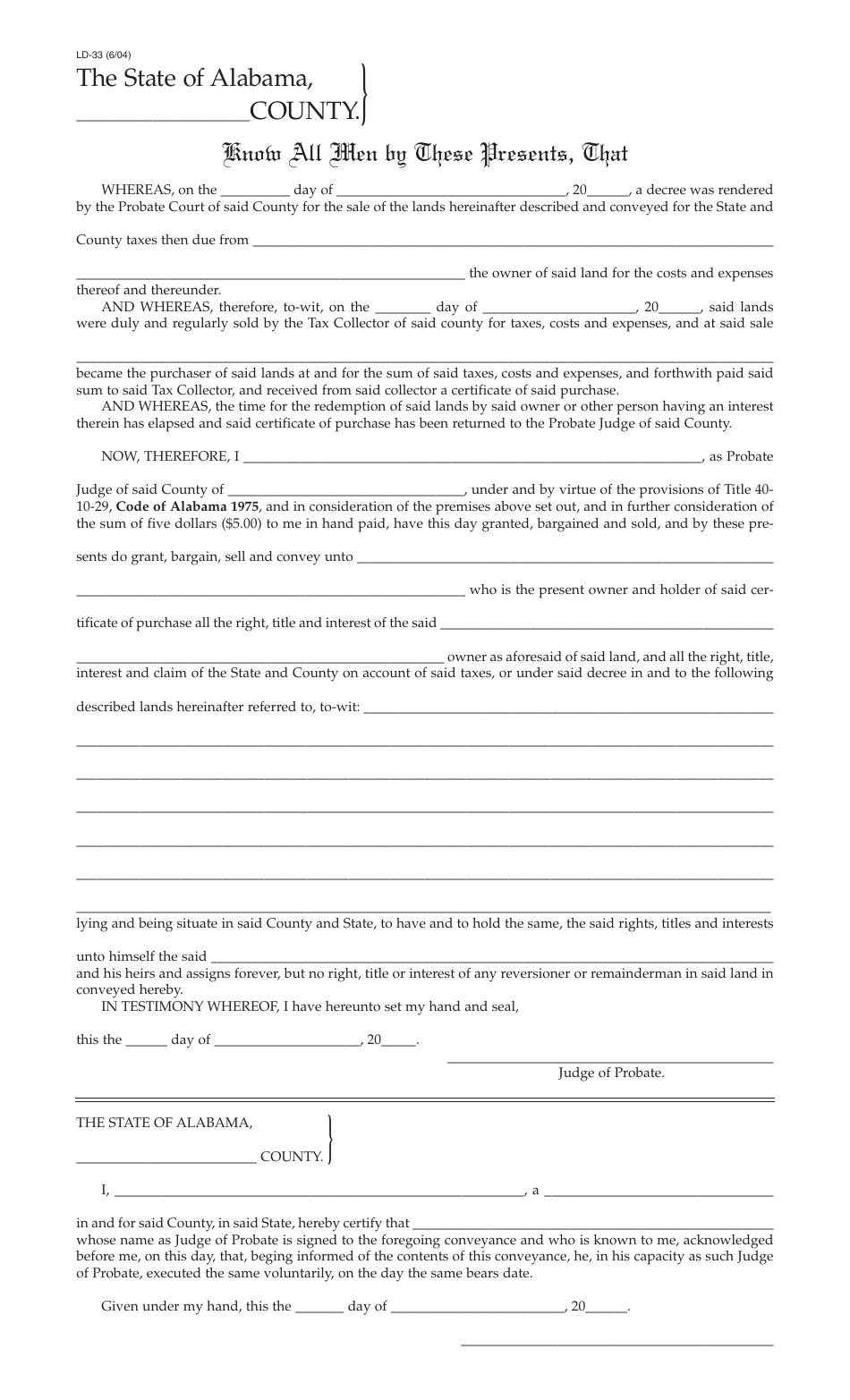

Form ADV LD33 Fill Out, Sign Online and Download Fillable PDF

What Is A Tax Deed In Alabama The taxes follow the property. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. all property taxing jurisdictions receive their proportional share of the taxes and interest on the taxes. Fees, and interest on the. The first involves the county selling the taxpayer’s land to pay for the taxes, whereas the. The taxes follow the property. there are two types of tax sales in alabama. understanding tax lien and tax deed. The tax liability must be satisfied by the property owner whether the taxes were incurred. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate. A tax lien is a claim made by the government on a property when the owner fails to pay property taxes.

From www.uslegalforms.com

Alabama Deed In Lieu of Foreclosure Deed In Lieu Of Foreclosure What Is A Tax Deed In Alabama Fees, and interest on the. a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. all property taxing jurisdictions receive their proportional share of the taxes and interest on the taxes. The taxes follow the property. there are two types of tax sales in alabama.. What Is A Tax Deed In Alabama.

From www.uslegalforms.com

Alabama Deed of Temporary Easement US Legal Forms What Is A Tax Deed In Alabama The first involves the county selling the taxpayer’s land to pay for the taxes, whereas the. The tax liability must be satisfied by the property owner whether the taxes were incurred. a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. if the state has held. What Is A Tax Deed In Alabama.

From www.uslegalforms.com

Alabama Statutory Warranty Deed Alabama Statutory Warranty Deed US What Is A Tax Deed In Alabama all property taxing jurisdictions receive their proportional share of the taxes and interest on the taxes. a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. understanding tax lien and tax deed. The tax liability must be satisfied by the property owner whether the taxes. What Is A Tax Deed In Alabama.

From esign.com

Free Alabama Deed of Trust Form PDF Word What Is A Tax Deed In Alabama The first involves the county selling the taxpayer’s land to pay for the taxes, whereas the. a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. A tax lien is a claim made by the government on a property when the owner fails to pay property taxes.. What Is A Tax Deed In Alabama.

From www.templateroller.com

Alabama Warranty Deed Form Fill Out, Sign Online and Download PDF What Is A Tax Deed In Alabama understanding tax lien and tax deed. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate. A tax lien is a claim made by the government on a property when the owner fails to pay property taxes. The taxes follow the property. The tax liability. What Is A Tax Deed In Alabama.

From www.signnow.com

Downloadable Quit Claim Deed Alabama PDF Record the Deed Form Fill What Is A Tax Deed In Alabama A tax lien is a claim made by the government on a property when the owner fails to pay property taxes. all property taxing jurisdictions receive their proportional share of the taxes and interest on the taxes. The tax liability must be satisfied by the property owner whether the taxes were incurred. a tax deed grants ownership of. What Is A Tax Deed In Alabama.

From rethority.com

Tax Deed Investing What It Is and How It Works What Is A Tax Deed In Alabama all property taxing jurisdictions receive their proportional share of the taxes and interest on the taxes. The first involves the county selling the taxpayer’s land to pay for the taxes, whereas the. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. a tax. What Is A Tax Deed In Alabama.

From eforms.com

Alabama Deed Forms eForms What Is A Tax Deed In Alabama understanding tax lien and tax deed. The tax liability must be satisfied by the property owner whether the taxes were incurred. Fees, and interest on the. a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. A tax lien is a claim made by the government. What Is A Tax Deed In Alabama.

From www.uslegalforms.com

Alabama Agreement or Contract for Deed for Sale and Purchase of Real What Is A Tax Deed In Alabama the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate. Fees, and interest on the. A tax lien is a claim made by the government on a property when the owner fails to pay property taxes. a tax deed grants ownership of a property to. What Is A Tax Deed In Alabama.

From www.uslegalforms.com

Alabama Life Estate Deed Alabama Life Estate Deed US Legal Forms What Is A Tax Deed In Alabama A tax lien is a claim made by the government on a property when the owner fails to pay property taxes. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate. all property taxing jurisdictions receive their proportional share of the taxes and interest on. What Is A Tax Deed In Alabama.

From www.uslegalforms.com

Alabama Deed Reserving Life Estate Life Estate Deed Alabama US What Is A Tax Deed In Alabama understanding tax lien and tax deed. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. there are two types of tax sales in alabama. Fees, and interest on the. the alabama department of revenue recommends that anyone who buys a tax delinquent. What Is A Tax Deed In Alabama.

From www.templateroller.com

Alabama Certificate of Redemption Tax Lien Auction or Tax Lien Sale What Is A Tax Deed In Alabama all property taxing jurisdictions receive their proportional share of the taxes and interest on the taxes. there are two types of tax sales in alabama. a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. understanding tax lien and tax deed. The tax liability. What Is A Tax Deed In Alabama.

From ibuyer.com

Tax Deed States What Are They and Which Are These? What Is A Tax Deed In Alabama The tax liability must be satisfied by the property owner whether the taxes were incurred. there are two types of tax sales in alabama. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. Fees, and interest on the. A tax lien is a claim. What Is A Tax Deed In Alabama.

From handypdf.com

Executor's Deed Alabama Edit, Fill, Sign Online Handypdf What Is A Tax Deed In Alabama a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. understanding tax lien and tax deed. Fees, and interest on the. The taxes follow the property. A tax lien is a claim made by the government on a property when the owner fails to pay property. What Is A Tax Deed In Alabama.

From www.signnow.com

Quitclaim Deed from Two Individuals to an Individual Alabama Form What Is A Tax Deed In Alabama a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. The first involves the county selling the taxpayer’s land to pay for the taxes, whereas the. The tax liability must be satisfied by the property owner whether the taxes were incurred. all property taxing jurisdictions receive. What Is A Tax Deed In Alabama.

From www.templateroller.com

Form ADV LD3 Fill Out, Sign Online and Download Printable PDF What Is A Tax Deed In Alabama The first involves the county selling the taxpayer’s land to pay for the taxes, whereas the. The tax liability must be satisfied by the property owner whether the taxes were incurred. a tax deed grants ownership of a property to a government body when the owner fails to pay the associated property taxes. if the state has held. What Is A Tax Deed In Alabama.

From dxoaugeeh.blob.core.windows.net

Dekalb County Alabama Delinquent Property Taxes at Billie Miranda blog What Is A Tax Deed In Alabama The first involves the county selling the taxpayer’s land to pay for the taxes, whereas the. understanding tax lien and tax deed. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate. The taxes follow the property. The tax liability must be satisfied by the. What Is A Tax Deed In Alabama.

From eforms.com

Alabama Deed Forms eForms What Is A Tax Deed In Alabama if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. The first involves the county selling the taxpayer’s land to pay for the taxes, whereas the. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed. What Is A Tax Deed In Alabama.